Key takeaways:

- Your business needs to send any pertinent W-2 forms for the last year’s taxes to both the employee and the IRS by January 31st.

- Employers fill out W-2 forms completely before sending.

- W-2 forms are only for full-time employees — not freelancers, independent contractors or similar workers.

If you have full-time employees, you need to send out W-2 forms every January, cataloging your employees’ wages and taxes for the previous calendar year. A W-2 is essential for your employees to file their tax returns and is one of the most common forms in the United States.

Here’s everything you need to know about W-2 forms.

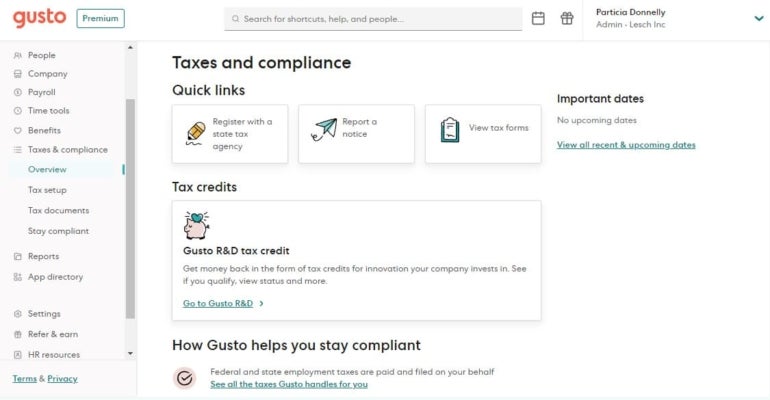

Taxes can be complicated, but with a capable payroll software like Gusto, you can better track tax information and set up helpful automations. That way, you can effortlessly stay compliant while focusing on other needs of the business. |

Featured partners

What is a W-2 form used for?

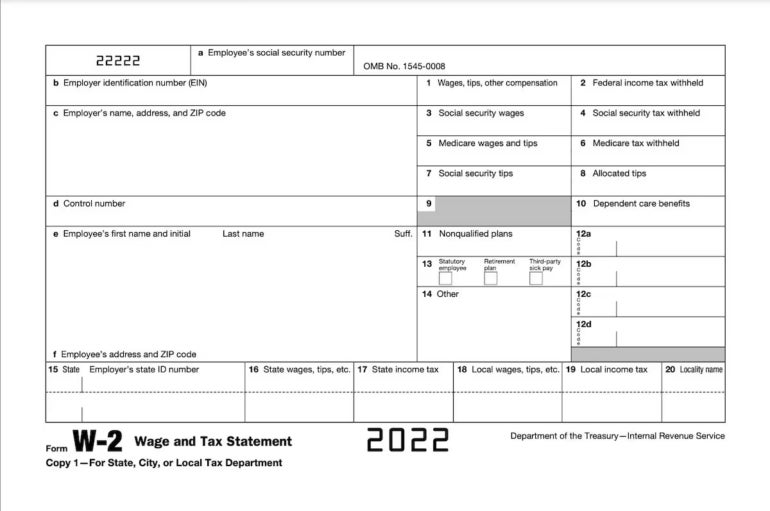

The IRS requires employers to submit a W-2 form (Figure A) for each employee. Essentially, a W-2 contains information that employees use to file their federal tax return. It shows how much the employee was paid during a calendar year and how much federal, state and local taxes were withheld from their paycheck.

Figure A

The W-2 forms will also include relevant fringe benefits such as health insurance, health savings account contributions, retirement account contributions, adoption assistance, dependent care assistance and more.

What is the difference between a W-2 and a W-4?

Employees fill out W-4 forms as part of their onboarding process. It tells the employer how much tax to withhold from future paychecks, and that information is used to calculate the correct paycheck and deductions each time the business runs payroll.

In contrast, a W-2 form is filled out by an employer at the end of the year and shows how much tax was withheld from past paychecks based on the information given on the W-4.

What is the difference between a 1099 and a W-2?

The 1099 form is issued instead of a W-2 when an employer does not withhold taxes from the worker’s paycheck. Instead, the 1099 worker is responsible for calculating and paying their own federal, state and local taxes.

So this means you don’t send out W-2s to freelancers, independent contractors, gig workers or non-employees. Instead, you’ll send either Form 1099-MISC or Form 1099-NEC, which document non-employee compensation. The W-2 documents employee compensation.

Does everyone get a W-2 form?

Full-time employees who are paid more than $600 in a calendar year should receive a W-2 form. If a worker is classified as a freelancer, independent contractor or non-employee, then you’ll send them a 1099 form instead.

What are the benefits of a W-2 employee?

From a business’s point of view, W-2 employees have quite a few advantages. They are essentially dedicated to your company during their working hours, so they can commit more time and effort to their tasks for better quality, consistency and familiarity.

While it’s good practice to listen to your employees and new hires and create agreements that benefit both parties, you do have some say over where employees work and when. That way, you can ensure they’re available at optimal times, and you can touch base with them much more easily.

However, in exchange for these perks, W-2 employees receive multiple protections under the law. Some common ones include overtime, minimum wage, family and medical leave, worker’s compensation and unemployment insurance. They also have the right to participate in their employer’s health and dental insurance plans, as well as their retirement plans. So you have to decide if these advantages are worth the cost of providing these benefits.

When should employees receive their W-2 forms?

The IRS requires businesses to send out their W-2 forms by January 31st of each year, which means employees should receive their W-2 somewhere around the end of January or the start of February (depending on whether it’s a digital or hard copy). Many companies use payroll software or other services to make employees’ W-2 forms available electronically (Figure B), though this is not required.

SEE: Best Payroll Software for Your Small Business in 2023

Figure B

As an employee, if it’s the first week of February and you still have not received your W-2 form, contact your employer to ask them for a status update and to provide you with an electronic copy if they haven’t already. If you still have not received your W-2 by February 16th, the IRS recommends contacting their toll free help line at 1-800-829-1040 for assistance. You must file your taxes on time even if you do not receive your Form W-2.

What types of information does a W-2 form contain?

Deciphering a W-2 can be tricky if you’ve never done it before, but fortunately, it’s pretty straightforward to interpret if you know what you’re looking at. Here is the information contained in your W-2 form:

- Box A: Employee’s Social Security Number.

- Box B: Employer identification number (EIN).

- Box C: Employer’s name, address and zip code.

- Box D: Control number.

- Box E: Employee’s first name, middle initial and last name.

- Box F: Employee’s address and zip code.

- Box 1: Wages, tips and other compensation that is taxable.

- Box 2: Federal income tax withheld.

- Box 3: Wages that are subject to the Social Security tax.

- Box 4: Social Security tax withheld.

- Box 5: Wages that are subject to the Medicare tax.

- Box 6: Medicare tax withheld.

- Box 7: Social Security tips (how much you reported in tips).

- Box 8: Allocated tips (how much your employer reported paying you in tips).

- Box 9: Used to report advanced income credit payments, which is now defunct, so this box should remain empty.

- Box 10: Dependent care benefits received from employer.

- Box 11: Deferred compensation income from a non-qualified plan.

- Box 12: Other types of compensation or reductions to your taxable income.

- Box 13: Pay that is not subject to income tax withholding.

- Box 14: Other tax information that doesn’t fit into any other boxes.

- Box 15: State and employer’s state ID number.

- Box 16: State wages, tips, etc.

- Box 17: State income tax.

- Box 18: Local wages, tips, etc.

- Box 19: Local income tax.

- Box 20: Locality name.

How does a W-2 work?

First, you as the employer will generate the W-2 form, which may be done manually or by using a payroll software platform or service. After you’ve put together the W-2 form, you send it to both the employee and the IRS.

From there, it’s all up to the employee. They use the information on their W-2 to file their tax return, and they’ll also attach their W-2 form when filing their taxes. The IRS then checks their tax return against the W-2 they have on file from you, the employer — alongside any other relevant forms — to ensure accuracy.

SEE: The Best Cheap Payroll Services for 2023

Ready to find payroll software that can automate the W-2 filing process for your business? Check out our guide that explains how to choose payroll software or read our top picks for the best payroll software of 2023.

Featured payroll solutions

1 Deel

Run payroll in 100+ countries and 200+ currencies from a single place. Deel’s comprehensive global platform eliminates the ongoing admin of local compliance, taxes, and benefits. With in-house experts across 100+ countries, dedicated CSM’s, visa and PTO support, and more, Deel provides unmatched payroll expertise and service. Plus, with a single point of contact, we eliminate handovers, providing you with faster support and compliance, so your entire global team gets paid quickly and securely.