Every business, from sole proprietorships to multinational corporations, needs an accurate way to record, categorize and track finances. General ledgers (GLs) are the comprehensive accounting document that helps you do all of the above — but how do GLs work, and what’s the easiest way to create one for your own business?

We answer these questions and more in our article below.

Instead of recording manual journal entries and building a general ledger by hand, automate your financial recording processes with accounting software. Free software options like Wave Accounting make general ledger creation as easy and simple as possible. |

What is a general ledger?

A general ledger (GL) is a comprehensive document comprised of individual accounts that catalog each financial transaction in the course of your organization’s existence.

Keeping a general ledger is foundational to your business’s financial success. It tells you how much money you have at any given moment, where your cash is flowing and what your key expenses are. It contains all the information you need to generate crucial accounting reports, including your balance sheet, income statement and cash flow statement.

Since general ledgers provide an exact record of every financial transaction taking place at your business, they’re also essential to catching potential accounting errors that could result in massive financial (and even legal) consequences for your business. An accurate ledger is also a good safeguard against issues like embezzlement and fraud.

How does a general ledger work?

General ledgers are the cornerstone of double-entry accounting. With this accounting method, each financial transaction is posted to the general ledger twice: Once as a credit and once as a debit. Entering each transaction twice helps you catch errors and ensure accuracy. Additionally, since a transaction is always debited from one account and credited to another, this method shows you where your money comes from and where it goes.

General ledgers are organized into accounts with each account representing a different type of transaction. (We talk more about the most common general ledger accounts below.)

Individual transactions are recorded in the general ledger as “journal entries.” You can create journal entries by hand and enter them into your GL manually, or you can use an automated accounting program that syncs with your bank account and credit cards to automatically generate journal entries with each transaction.

|

Why do companies use general ledger accounts?

Checking your business bank account gives you a quick look at exactly how much money you have at a specific moment in time — but that’s the only real information it gives you.

In contrast, a general ledger breaks down exactly how much money your business makes, showcases how you spend that money and documents how much you owe your creditors and how much is owed to you in return.

Plus, since the general ledger is essential to double-entry bookkeeping, it helps companies ensure financial accuracy. Recording each transaction twice in two separate accounts shows you exactly where your money comes from and where it goes, but it also keeps you from overspending or running up a balance you can’t actually afford.

General ledgers are also crucial for generating financial documents that show you, your shareholders and other stakeholders in your business how well you’re performing financially. These documents include the following:

- Income statements, also known as profit & loss statements, which list your income (profits) and expenses (losses) over a specific time period.

- Balance sheets, which lay out a snapshot of your assets and liability at a given moment in time.

- Cash flow statements, which outline where cash is flowing into your business and where it’s flowing out of your business.

Without these foundational accounting reports, you’ll struggle to glean insights into issues like where you need to cut costs and which operations you should invest more in to increase your profit margins. And because they offer a quick overview of your business’s financial standing, these financial reports are pivotal to applying for a business loan and maintaining transparency with your shareholders.

|

Types of general ledger accounts

General ledgers are made up of (and organized by) accounts, or subsections that categorize financial transactions by type. The accounts in turn may include sub-accounts or sub-ledgers, which record more precise details about each transaction.

Each business customizes its accounts to its specific needs, so you may or may not have all of the accounts listed below in your general ledger. Still, these are the most common types of general ledger accounts:

- Asset accounts, which could include cash accounts and accounts receivable.

- Liability accounts, which could include accounts payable and loans.

- Equity accounts, which could include stock and retained earnings.

- Operating revenue accounts, which could include sales and fees.

- Operating expense accounts, which could include salaries and equipment depreciation.

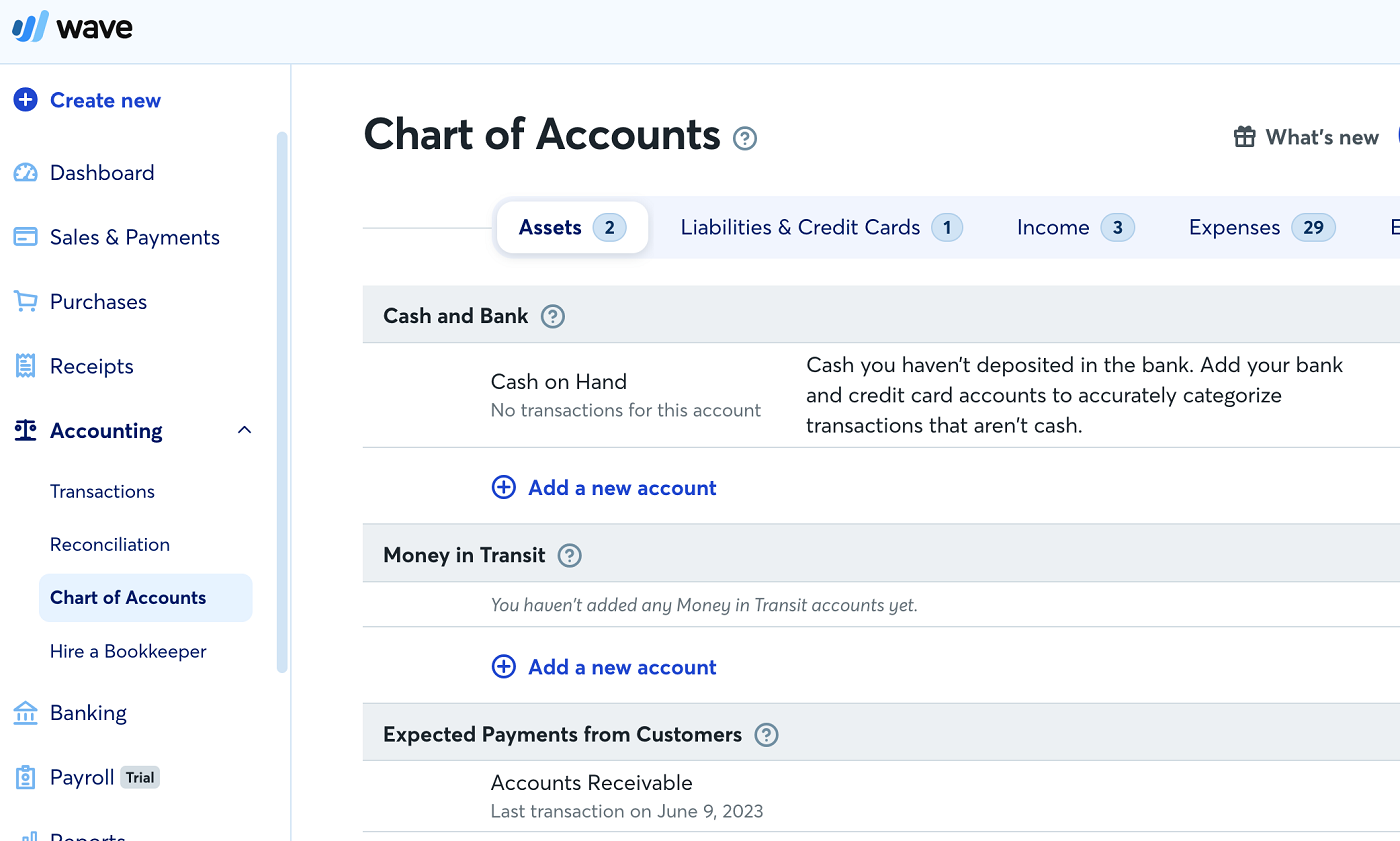

For the most part, general ledgers included with accounting software come pre-built with the most common account types (Figure A). Depending on the software and plan, you can also add custom accounts unique to your specific business.

General ledger reconciliation process

What is GL reconciliation?

General ledger reconciliation is the process of making sure your GL is accurate. You (or your accountant) will check the transactions recorded in your general ledger against primary documents like receipts, tax documents, invoices and other records. You’ll make sure every transaction is accurate and has been correctly recorded as both a credit and debit in the appropriate accounts.

Benefits of general ledger reconciliation

This process should reveal any financial errors and help you catch transactions you forgot to record (or recorded incorrectly). Crucially, it should also give you — and other stakeholders in your business, like lenders and co-owners — peace of mind, knowing you can trust the records you use to make vital business decisions.

Reconciling your general ledger is comparable to balancing a checkbook. Put as simply as possible, you want to make sure all of your accounts are balanced, meaning your debits and credits are perfectly weighted.

4 steps to general ledger reconciliation

If you use accounting software, the software itself should guide you through the process of reconciliation. (If you work with an accountant, they’ll perform the same process using whichever accounting software their firm works with.) Generally speaking, you’ll follow these steps to reconcile your ledger.

- Gather financial documents like your credit card statement, bank statements, customer invoices, bills and any other records of transactions since your last general ledger reconciliation.

- Go through your general ledger account by account, starting with asset accounts, and verify that each transaction has been recorded correctly.

- If you find incorrect transactions, generate correcting journal entries to bring your books back into balance.

- Once you’ve verified that everything is accurate and have fixed any mistakes, you can close the books, meaning officially end this financial recording period and start the next.

Ideally, you should reconcile your general ledger once a month. It’s much easier to reconcile transactions when they’re still fresh in your mind, which they won’t be if you put off reconciling your books once a year for tax season.

How to find general ledger software

Most accounting software programs are pre-programmed with a general ledger and chart of accounts, including free software like Wave Accounting. Accounting software automates some of the most tedious aspects of general ledger reconciliation, such as automatically generating journal entries and streamlining bank reconciliation.

Not all accounting programs include all accounts, though. For instance, QuickBooks Online only includes accounts receivable and payable with its higher-tier plans.

Additionally, not all plans offered by the same accounting company include general ledgers. For instance, unlike FreshBooks’ higher-tier plans, its cheapest plan (FreshBooks Lite) doesn’t include double-entry accounting. While you can definitely track income and expenses with FreshBooks Lite, you can’t break down transactions by account and you won’t have a general ledger to reconcile.

Learn more about how to find and choose the best GL software for you by reading our complete guide to accounting software. You can also cut right to the chase by checking out our top accounting software recommendations below.

| Vendor | Best for… | Starting price | Top payroll integration | Learn more |

|---|---|---|---|---|

| FreshBooks | Service-based contractors | $19/mo. | Gusto | |

| QuickBooks | Small to midsize businesses | $30/mo. | QuickBooks Payroll | |

| Wave Accounting | Budget-conscious businesses | $0/mo. | Wave Payroll | |

| Xero | Freelancers | $15/mo. | Gusto | |

| Zoho Books | Businesses planning on growth | $0/mo. | SurePayroll by Paychex | |

| Sage Intacct | Big businesses and enterprises | Custom | Sage Payroll |

Plan and pricing information up to date as of 11/30/2023.

Frequently asked questions

What is a general ledger in simple terms?

A general ledger is a master accounting record used by businesses to document and categorize their financial transactions. General ledgers are an essential component of double-entry accounting. General ledgers are organized into accounts, or types of transactions, which are listed in the general ledger’s chart of accounts.

What items are in the general ledger?

A general ledger records transactions. Along with dollar amounts, the GL includes transaction details like the date the transaction occurred. Most general ledgers are organized into five main types of accounts: Assets, liabilities, owner’s equity, operating expenses and operating revenues.

Read next: What Are Generally Accepted Accounting Principles? (TechRepublic)